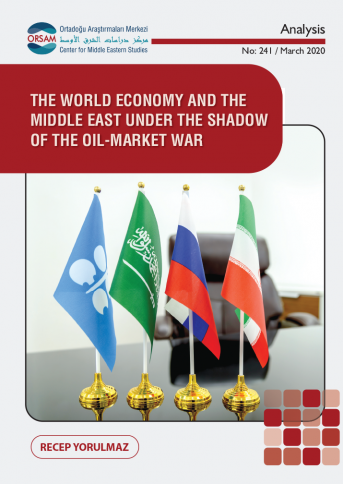

The World Economy and the Middle East under the Shadow of the Oil-Market War

The new coronavirus came to the agenda with 4 infected people who worked in a market selling seafood and live animals and also with others who visited this market on the same days for the first time on December 29, 2019, in Wuhan, China. It is now present in many parts of the world, especially China.1 This virus has rapidly spread all over the world and threatens the world economy. It can be observed that the virus negatively affects the world economy in this environment where the number of confirmed cases exceeds 600 thousand. As the number of the cases and deaths have increased, the course of the disease has begun to show perceptible effects on the global economy. In particular, it has led to fluctuations in stock prices and suppressed earnings projections and even delayed movie releases and major sports events.

While the whole world is busy with the epidemic, the decrease in oil prices, among the reasons for which we may find the effects of the epidemic, has turned the world’s attention to Russia and Saudi Arabia, which were the main actors in this decline. After these two countries failed to agree on the decision to make additional cuts in crude oil production, oil prices have fallen to the lowest level in the last four years due to the decision of Saudi Arabia to increase production, as well as the decrease in China’s imports. On a percentage basis, it has fallen more than 30 percent, suffering the most severe daily loss since the Gulf War in January 1991. This decline is important as it will hurt the economies of the two countries and damage US oil production. While discussing how long the US shale oil producers, who experienced a similar shock in 2014-2016, can hold on to the market at this price level, the situation also raises concern over to what extent Russia’s motivation targets these companies.